Navigating the Path to Education Savings With 529 Plans

Planning for the financial aspect of education is a critical step on the journey to academic success. For students and parents, 529 plans offer a strategic way to save for future education costs. These plans are not just savings accounts; they are investment vehicles designed to make higher education attainable, offering tax advantages and flexibility for a variety of educational scenarios.

What is a 529 plan?

In a nutshell, a 529 plan is a special account designed to make the money you save for paying education expenses go a lot further than it normally would. These accounts tend to have a higher return rate than a normal savings account you’d have with a bank, though not guaranteed, and the money you keep in the account is shielded from taxes if you spend it on education-related expenses.

A more formal definition is that it is a tax-advantaged savings plan designed to encourage saving for future education costs. Contributions to a 529 plan grow tax-free, and withdrawals for qualified education expenses, such as tuition, books, technology, and certain room and board costs, are also tax-free. However, it's important to note that withdrawals not used for these qualified education expenses may be subject to income tax and an additional 10% federal tax penalty on earnings. This ensures the funds are used for their intended purpose: education.

Some plans even allow for tax deductions or credits on state income tax returns, making them a powerful resource in your education funding tool bag. Always consult with a tax advisor or financial professional to understand the specific rules and potential implications of your 529 plan, but you can easily get started with an internet search using the name of your state and “529 plan” as your terms.

| As with all saving strategies, the earlier you start the better — and its never too late to begin! |

Who can benefit from a 529 plan?

529 plans cater to a diverse range of educational goals. Whether you're a high-achieving student with sights set on a prestigious university, a first-generation student navigating the college process, or someone exploring vocational and trade schools, a 529 plan can support your ambitions. These plans are designed to be inclusive, ensuring that every student has the opportunity to save for education, regardless of their path.

How to open a 529 plan

The first step in starting a 529 plan involves seeking guidance. Financial advisors, tax professionals, and college planning specialists can help you navigate the setup process. They will explain how contributions, withdrawals, and tax benefits work. Importantly, your immigration status does not prevent you from opening or benefiting from a 529 plan. As with all saving strategies, the earlier you start the better — and it’s never too late to begin.

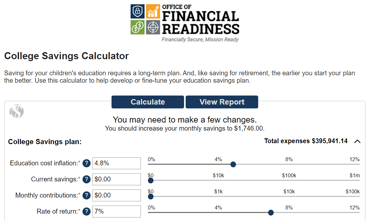

Visualizing your investment

Use this college savings calculator from investor.gov (an official website hosted by the U.S. government) to estimate college expenses and pace your savings goals. It only takes about 3 minutes to use, and it can give you the insights you need to make your best financial decisions about your education spending.

Uncovering Answers to Your 529 Plan Questions

Can I use a 529 plan for trade school?

Yes, 529 plans can be used for vocational and trade schools, offering flexibility for various career paths.

What if I don't go to college immediately after high school?

The funds in a 529 plan can be used at any time. Whether you take a gap year or decide to pursue education later in life, your 529 plan will be available to support you.

How does a 529 plan affect financial aid?

A 529 plan can impact financial aid eligibility, but typically less so than other savings accounts. A financial advisor can help you understand how to use your 529 plan effectively alongside financial aid.

Government resources on 529 plans

For more detailed information, the following government resources are invaluable:

U.S. Securities and Exchange Commission - Introduction to 529 Plans

IRS - Tax Benefits for Education: Information Center

Chart your course with ACT's financial planning resources

ACT offers a wealth of resources to help you plan for college and career. Explore our student and parent college and career planning resource pages for more guidance.

Setting milestones for educational success

A 529 plan is a commitment to your educational and career success. By starting early and understanding your options, you're investing in your future. ACT is here to support you at every step, ensuring you have the resources you need to make informed decisions about the future of your education.